Cruise Cash vs. Sail & Sign: A Comprehensive Guide

When cruising with Carnival, managing onboard expenses efficiently can greatly enhance your vacation experience. Carnival offers two main payment options: Cruise Cash and the Sail & Sign program.

In this guide, I’ll explain the differences, highlight their pros and cons, and help you decide which option suits your needs. Additionally, I’ll share insights into other payment methods, practical tips, and how Carnival’s VIFP Club Loyalty Program ties into these options.

Understanding Cruise Cash

Cruise Cash is a pre-purchased, non-refundable credit you can buy before your cruise starts. It’s applied directly to your Sail & Sign account (Carnival’s cashless onboard credit program) and can be used for various onboard expenses.

Cruise Cash is a great way to pre-plan your spending, but keep in mind it’s non-refundable and must be used within the same voyage. Any unused credits will be forfeited once the trip ends.

It comes in specific denominations like $25, $50, $75, and $100 and can be designated for general spending or specific categories such as bars or spa services.

You can choose from several Cruise Cash categories:

- Cruise Cash: Spend it on anything onboard, including gratuities.

- Cruise Cash Bar: Reserved for bar purchases like cocktails or sodas.

- Cruise Cash Photo: Perfect for purchasing those memorable cruise photos.

- Cruise Cash Entertainment: Use it for activities like Bingo, IMAX movies, or special events.

- Cruise Cash Build-A-Bear Workshop at Sea: Exclusively for Build-A-Bear Workshop purchases.

However, there’s a significant caveat: Cruise Cash is non-refundable, meaning any unused balance is forfeited at the end of the voyage. (Carnival Help Center)

Key Features of Cruise Cash:

- Prepaid convenience for budgeting.

- Available in set denominations.

- Can be designated for specific categories.

- Non-refundable; unused credits are lost.

Understanding Sail & Sign

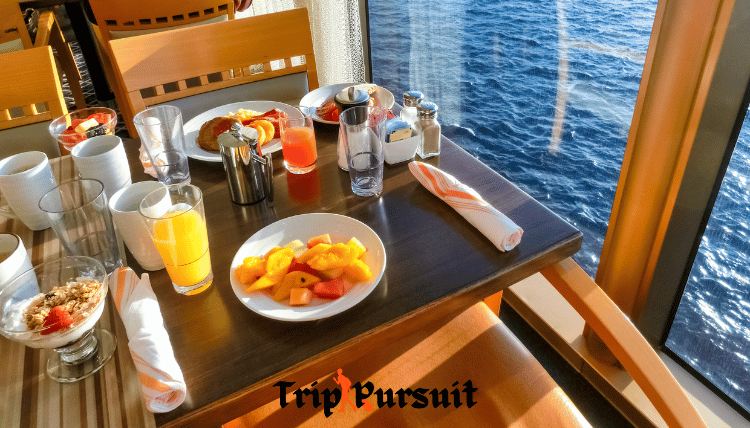

The Sail & Sign program is Carnival’s cashless onboard payment system. Each guest receives a Sail & Sign card upon check-in, which functions as a charge card for all onboard purchases.

The account can be linked to a credit card, debit card, or cash deposit.

The Sail & Sign card also proves convenient for booking tours and adventures, such as the popular Coco Cay Snorkeling experience, straight from the ship.

Key Features of Sail & Sign:

- Allows all onboard purchases to be charged to your account.

- Can be linked to various payment methods.

- Refundable if there are unspent cash deposits.

- Offers a seamless way to manage expenses during the cruise.

How to Link Your Credit Card to Sail & Sign

- Online Check-In (Before Your Cruise):

- Log in to your Carnival account on their official website or app.

- During the check-in process, select the option to set up your Sail & Sign account.

- Add your credit card details to link it to your Sail & Sign card.

- At the Cruise Terminal (During Embarkation):

- If you didn’t set up your Sail & Sign account online, you could do it at the terminal during check-in.

- Provide your credit card to the staff, who will link it to your account on the spot.

- Onboard the Ship:

- Head to Guest Services if you didn’t link your card before boarding.

- Provide your credit card, and they’ll set it up for you.

Key Points to Remember

- Authorization Hold: Carnival will place an initial hold (usually $100) on your card to cover onboard expenses. Additional holds may apply if you exceed the initial amount.

- Real-Time Tracking: You can monitor your spending via the Carnival Hub app or at kiosks around the ship.

- Security: Only you or authorized users can charge expenses to your Sail & Sign card.

Why Link a Credit Card?

Linking a credit card provides flexibility and convenience. Unlike cash deposits, you won’t need to worry about running out of funds mid-cruise, and any unused balance will be refunded after the trip.

Cruise Cash vs. Sail & Sign: Key Differences

| Feature | Cruise Cash | Sail & Sign |

|---|---|---|

| Definition | Prepaid credit for onboard purchases. | Cashless onboard payment system. |

| Refundability | Non-refundable; unused funds are forfeited. | Refundable if linked to a cash deposit. |

| Purchase Timing | Must be purchased in advance. | Set up during check-in. |

| Usage | Can be category-specific or general. | Covers all onboard purchases. |

| Flexibility | Limited to the prepaid amount. | Unlimited, based on payment method linked. |

Pros and Cons of Each Option

Cruise Cash

Pros:

- Helps you stick to a budget by prepaying a specific amount.

- Can be a thoughtful gift for fellow travellers.

Cons:

- Unused funds are forfeited.

- Must be purchased in advance, which requires planning.

- Restricted to specific categories if designated.

Sail & Sign

Pros:

- Offers flexibility by linking to a credit/debit card or cash.

- Refundable if cash deposits remain unused.

- Covers all onboard purchases, from drinks to excursions.

Cons:

- Easy to overspend without proper monitoring.

- Requires linking to a financial account or cash deposit.

Moreover, when considering off-ship excursions, such as evaluating how good the AT&T tour plans are, Sail & Sign provides easy, hassle-free bookings.

Should You Take a Normal Credit Card or a Traveler Credit Card on a Cruise?

Normal Credit Cards

A normal credit card (your everyday card) can be convenient and sufficient if:

- Your Card Doesn’t Charge Foreign Transaction Fees: Many standard credit cards now waive foreign transaction fees, which makes them as cost-effective as traveler cards.

- You’re Earning Rewards: If your card offers cash back or travel points for purchases, you can benefit from using it for onboard expenses and excursions.

- You Prefer Simplicity: Using the same card for all purchases can streamline your financial management, especially if you monitor spending closely.

Best for:

- Domestic cruises where foreign transaction fees aren’t a concern.

- Travelers with credit cards that already offer travel-friendly benefits.

Traveler Credit Cards

A traveler credit card is specifically designed for travel-related expenses. It might be a better choice if:

- You’re Cruising Internationally: These cards often waive foreign transaction fees, which can save you 1%-3% per purchase.

- You Want Travel Insurance Benefits: Many traveler cards include perks like trip cancellation insurance, baggage protection, and emergency assistance, which can be valuable on cruises.

- You Seek Higher Rewards: Travel cards often provide extra points or rewards for travel-related purchases, including cruises.

- You Value Security: Traveler credit cards often have enhanced fraud protection, which is helpful if your card gets lost or stolen abroad.

Best for:

- International cruisers looking to avoid foreign transaction fees.

- Travelers who want additional travel perks and protections.

Which Is Best for a Cruise?

Take a traveler credit card if:

- You’re cruising internationally and your normal card has foreign transaction fees.

- You want travel-specific perks and benefits.

Stick with your normal credit card if:

- It doesn’t charge foreign transaction fees.

- You’re cruising domestically, and your card already provides rewards or cash back.

Pro Tips for Using Credit Cards on a Cruise

- Notify Your Bank: Let your credit card provider know you’ll be traveling, especially internationally, to avoid unexpected declines.

- Carry a Backup Card: Always have a second card in case of issues with your primary card.

- Check Exchange Rates: For international cruises, compare your card’s currency conversion rates to see if they’re competitive.

- Avoid Dynamic Currency Conversion: If given a choice, always pay in the local currency of the destination to avoid extra fees.

Best Travel Credit Card for Cruisers

Comparison of Top Travel Credit Cards for Cruises

| Card Name | Rewards Rate | Annual Fee | Cruise Perks | Cashback/Sign-Up Bonus | Foreign Transaction Fees |

|---|---|---|---|---|---|

| Chase Sapphire Preferred® Card | 5x on travel via Chase Ultimate Rewards, 2x on other travel, 3x on dining | $95 | Points worth 25% more for travel via Chase (including cruise bookings) | 60,000 points (worth $750 for travel) after spending $4,000 in 3 months | None |

| Capital One Venture Rewards | 5x miles on hotels/rentals via Capital One Travel, 2x on all purchases | $95 | Use miles to erase cruise purchases as travel expenses | 75,000 miles after spending $4,000 in 3 months | None |

| Bank of America® Travel Rewards | 1.5x points on all purchases | $0 | Redeem points as statement credits for cruise-related travel | 25,000 points (worth $250) after spending $1,000 in 90 days | None |

| The Platinum Card® from Amex | 5x on flights/hotels booked via Amex Travel, 1x on other purchases | $695 | Exclusive benefits like cruise credits and concierge services | 100,000 points after spending $6,000 in 6 months | None |

| Citi Premier® Card | 3x on air travel, hotels, and dining | $95 | Transfer points to participating cruise line loyalty programs | 60,000 points (worth $600) after spending $4,000 in 3 months | None |

Best Cards for Specific Needs

- Budget-Friendly Option:

- Bank of America® Travel Rewards: No annual fee and straightforward rewards structure make it ideal for occasional cruisers.

- Maximizing Rewards:

- Chase Sapphire Preferred® Card: The 25% travel redemption boost via Chase Ultimate Rewards makes this a great choice for cruise bookings.

- Luxury Perks:

- The Platinum Card® from Amex: Offers access to concierge services, cruise credits, and elite travel perks perfect for high-end cruise experiences.

- Flexibility:

- Capital One Venture Rewards: Use miles to cover a wide range of travel purchases, including excursions, dining, and onboard spending.

- Transferable Points:

- Citi Premier® Card: Ideal for cruisers who want to transfer points to cruise loyalty programs for extra savings.

Key Perks for Cruisers

- Redeeming Points for Cruises:

Cards like Chase Sapphire Preferred and Capital One Venture allow you to book cruises or use points to erase cruise expenses as statement credits. - Onboard Spending Benefits:

Some cards, such as the Amex Platinum, offer credits or discounts for onboard spending. - Travel Insurance:

Many of these cards offer trip cancellation, interruption insurance, or baggage protection, which are crucial for cruises. - No Foreign Transaction Fees:

Perfect for international cruises, all listed cards waive foreign transaction fees.

Recommendation

- If you’re a budget-conscious cruiser, go for the Bank of America® Travel Rewards Card.

- If you value luxury and perks, the Amex Platinum Card offers unmatched benefits for high-end cruises.

- For everyday use and versatility, the Chase Sapphire Preferred® Card strikes the best balance.

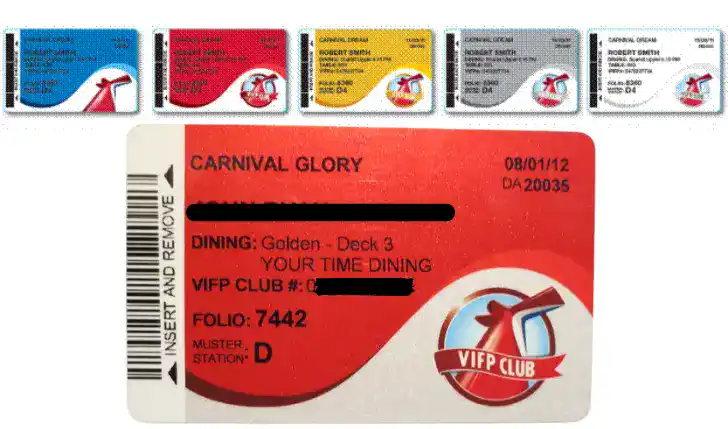

VIFP Club Loyalty Program and Its Connection to Cruise Cash and Sail & Sign

Carnival’s Very Important Fun Person (VIFP) Club rewards repeat cruisers with points and perks based on the number of days they’ve sailed.

Depending on your loyalty level (Blue, Red, Gold, Platinum, or Diamond), you might unlock benefits that influence how you use Cruise Cash or Sail & Sign.

How the VIFP Program Impacts Onboard Spending:

- Discounts and Offers: Members often receive exclusive promotions for purchasing Cruise Cash or onboard credit before sailing. Platinum and Diamond members may also get perks like priority access or complimentary items, which can offset the need for additional prepaid Cruise Cash.

- Special Privileges: Higher-tier VIFP members get perks such as free drinks at designated times, which reduces the need to allocate Cruise Cash specifically for bar expenses.

- Sail & Sign Benefits: Members at higher levels receive perks like early embarkation, priority lines, or even free laundry services, which can be conveniently tracked on their Sail & Sign accounts.

- Earn Points with Spending: Spending onboard with your Sail & Sign account can indirectly help you climb loyalty tiers, as every cruise day counts toward higher status.

Should VIFP Members Use Cruise Cash or Sail & Sign?

- Cruise Cash: If you’re using VIFP member-exclusive promotions to buy Cruise Cash, it can be a cost-effective way to prepay for onboard expenses. However, consider only purchasing the amount you know you’ll spend since it’s non-refundable.

- Sail & Sign: For high-tier members with complimentary perks, using the Sail & Sign program linked to a credit card may be a better option, offering flexibility and avoiding the risk of forfeiting unused Cruise Cash.

Other Payment Options

While Cruise Cash and Sail & Sign are popular, there are other ways to manage onboard expenses:

- Credit Cards: Linking your Sail & Sign account to a credit card offers rewards points and avoids the risk of forfeiting unused funds. (Reddit)

- Cash Deposits: If you prefer not to link a card, you can deposit cash at check-in, and any unspent amount will be refunded.

Pro Tip: Using a travel credit card with no foreign transaction fees can save you money while earning points for future trips.

User Experiences and Insights

Many cruisers have shared their experiences regarding these payment options:

- Discounted Gift Cards: Some travelers purchase discounted Carnival gift cards through programs like AARP and apply them to their Sail & Sign accounts, effectively saving money on their cruise expenses.

- Non-Refundable Nature of Cruise Cash: Users emphasize that Cruise Cash is non-refundable, cautioning others to plan their spending carefully to avoid losing unused funds.

FAQs

- Can Cruise Cash be used for all onboard purchases?

- Cruise Cash can be used for general purchases or specific categories like bars or spa services if designated. (Carnival Help Center)

- What happens to unused Cruise Cash?

- Any unused Cruise Cash is forfeited at the end of the cruise.

- How do gratuities work with Sail & Sign?

- Gratuities are automatically charged to your Sail & Sign account unless prepaid before the cruise.

- Is Sail & Sign mandatory on Carnival cruises?

- Yes, all onboard purchases require a Sail & Sign account, even if linked to cash.

Tips for Managing Onboard Expenses

- Monitor Your Spending: Check your account balance regularly using Carnival’s onboard systems or mobile app.

- Plan for Gratuities: Decide whether to prepay or have them charged to your account.

- Avoid Overspending: Set a budget and track your expenses daily to stay within your limit.

- Redeem Credit Card Rewards: Use a travel credit card linked to your Sail & Sign account to earn points for future trips.

Similarly, when choosing between different cruise ships, such as Eurodam and Westerdam options, knowing your preferred onboard expense system can influence your decision.

Final Thoughts

Choosing between Cruise Cash and Sail & Sign depends on your spending habits and preferences. If you prefer a prepaid, controlled option, Cruise Cash may work for you. For greater flexibility and convenience, Sail & Sign is the better choice. Whichever you choose, understanding the pros and cons will help you make the most of your Carnival cruise.

For more information, visit Carnival’s Official Website. Happy cruising!